More than $56m in cryptocurrency has been seized by RCMP in the largest operation in Canadian history. The money was recovered from the platform TradeOgre, marking, according to cops, the first time that a cryptocurrency exchange platform has been dismantled by Canadian law enforcement. Cops opened the file in June 2024, following a tip from Europol.

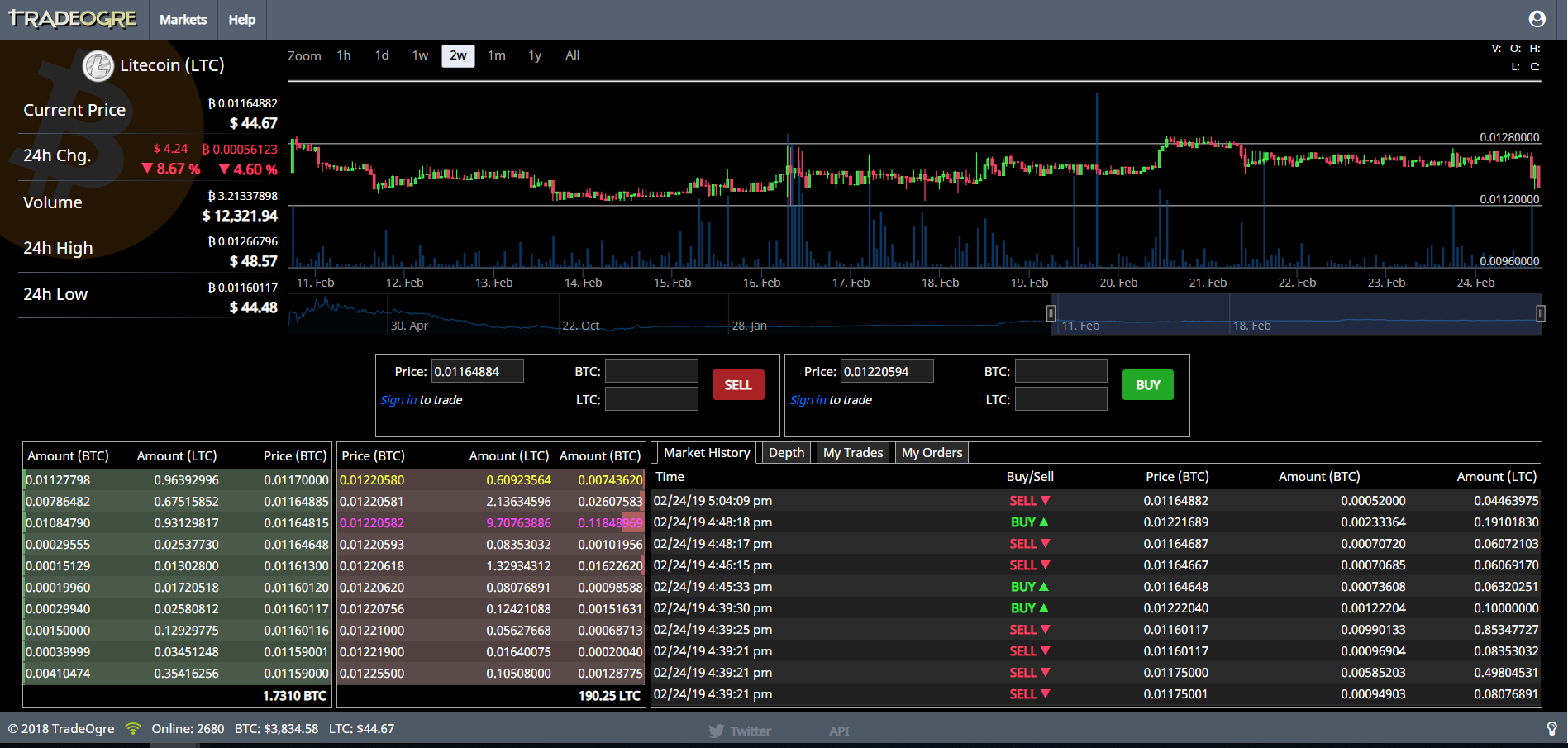

The trading platform supported trading in 56 different cryptocurrencies. TradeOgre carved a niche for itself as the go-to platform for traders who demanded anonymity. One of the hallmarks of an anonymous crypto exchange is a No-KYC policy. With no requirement to ‘Know Your Client’ users can start washing dirty money without undergoing identity checks. Such exchanges support privacy coins like Monero and Zcash. TradeOgre did not explicitly prohibit US-investors. The coin exchange had a 0.20% flat fee on all fulfilled orders, in line with industry average.

The platform contravened Canadian laws and regulations. It failed to register with FINTRAC as a money services business and didn’t identify its clients. Cops say the majority of funds transacted on TradeOgre came from criminal sources. The platform didn’t require users to identify themselves to open an account. It also hides the source of funds. The fraud job outfit hasn’t used its still operating Twitter account since May 2025. https://x.com/tradeogre

Cops haven’t laid charges yet and aren’t saying who was behind TradeOgre. Registered in California in 2018, internet rumour says the scam was based out of Montreal. TradeOgre was particularly popular among users of the privacy coin Monero. To sign up with TradeOgre, users needed nothing more than an email address. Two months ago, users first began noticing that TradeOgre’s website went offline and the exchange had ceased all public communication. This morning TradeOgre funds were on the move – to an address controlled by the Canadian Government. Over the course of a little over four hours, the address reached a balance of more than 126 BTC, or close to $15m. At the same time, TradeOgre Ethereum funds were drained for another $17m.

RCMP seizes $56m in crypto from TradeOgre

by

Tags:

Leave a Reply